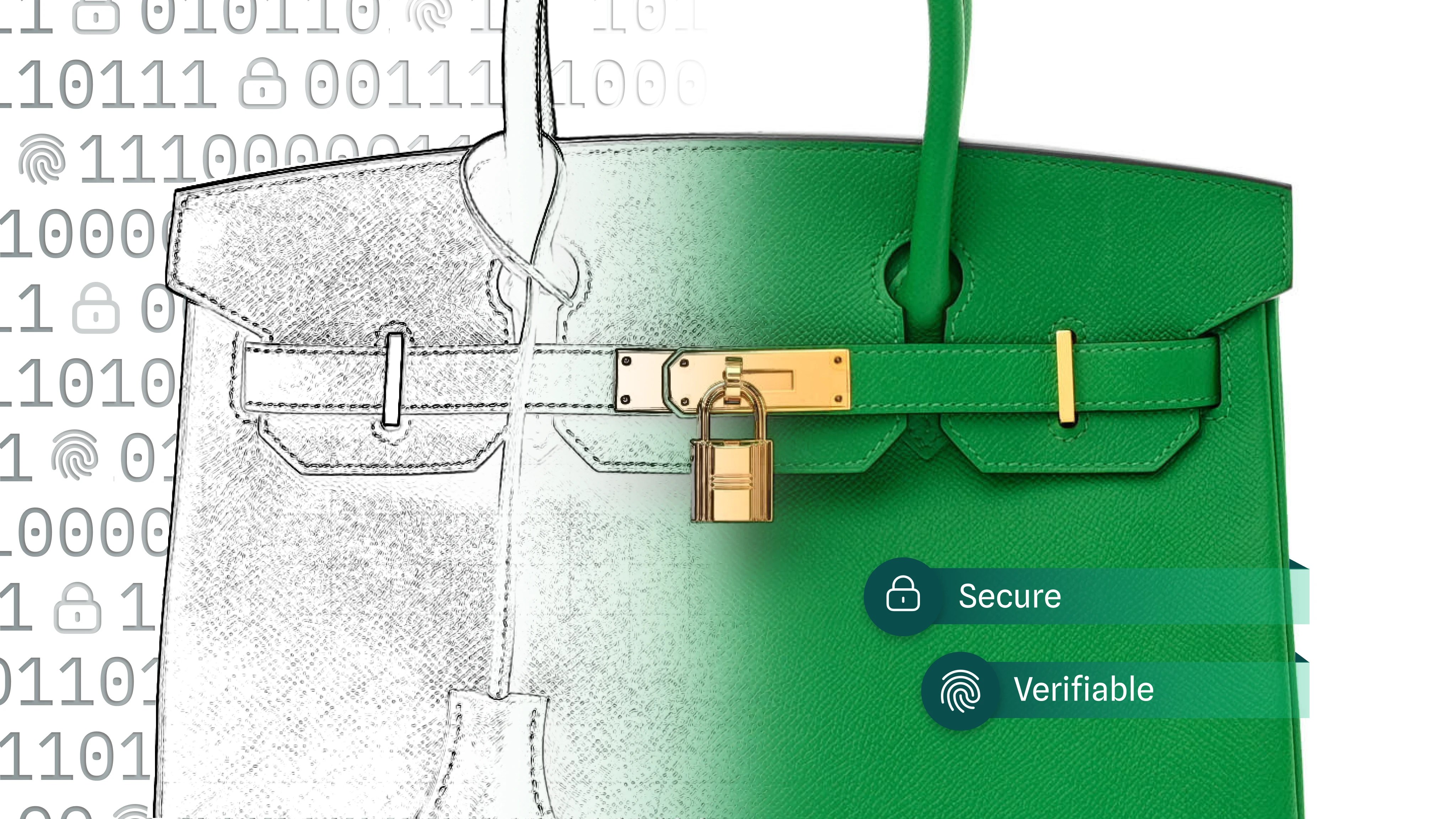

Blockchain smart contract development thus far has occurred in the straight jackets of the Ethereum Account Model and Solidity. These constraints, combined with the abject fear that currently accompanies self-custody on Bitcoin or Ethereum, means that we’ve designed and built things that look like TradFi, are overly centralized, or worse – both.

It doesn’t have to be this way.

True peer-to-peer markets will work very differently, but first, I must point out an important human foible. When we look around the world and “how things are done now,” we often overlook the massive inefficiencies or poor designs we take for granted because they mostly work. The idea that you can only trade stocks from 9:30 AM to 4 PM Eastern time and buyers and sellers have access to only the liquidity inside national borders or those sophisticated enough to reach across national borders – is ridiculous when you stop to think about it.

Chia Offers

Chia Offers let buyers and sellers trustlessly propose a transaction and complete it via any communications mechanism. Yes, you can even strap a QR code to a carrier pigeon (but email and the web are likely a bit handier). For example, an Offer may seek $60 worth of wrapped USDC for 1 $XCH. Note: The Offer is very specific – it proposes to trade exactly this coin or a small batch of coins for a buyer’s coin or coins that otherwise meets the requirements of the Offer.

We suspect there will be competing stablecoins on the Chia blockchain. Could that cause poor liquidity as each stablecoin must be paired to every asset and not really interoperate? Yes.

So, we built the capability for multiple Offers. Anytime someone offers an asset, they make an Offer file for that asset, represented as a token, paired to any other asset they’re willing to take. In the case of an art NFT, that would mean something like an Offer for that NFT in BYC, WUSDC, USDS, WPYUSD, WUSDT, etc. Then broadcast those as each one is a couple of kilobytes, and you can use something fully decentralized like Dexie Splash.

When a buyer decides to take the Offer using WPYUSD, all of the other Offers will immediately cancel themselves as they refer to the same coin that has now been spent. We could make Offer files that supported all those options, but we want to optimize for the smaller on-chain size, and the straight pairings are much smaller on chain.

The other convention we want to introduce is the use of expiring Offers. Suppose you’re actively making a market selling carbon credits from your carbon project. You will probably set them to expire every 5 minutes, and you can rebroadcast new Offers at updated prices as your bot watches the market.

Buyers can subscribe to the assets they care about and filter out the rest of the flow over something like Splash.

One Market

With these capabilities, we suddenly have one market everywhere the internet touches, and it trades 24/7. Further, there really aren’t liquidity pools because all assets can be offered in whatever liquidity happens to be around. Add some folks taking a narrow cut placing Offers between say WUSDC and WPYUSD – and 24/7 high-frequency trading and deep liquidity are now available for any asset on the Chia Blockchain.

Chia’s technology enables the Internet of Markets: one market, no trust, no middlemen, just math.